Relief For Student Loan Borrowers

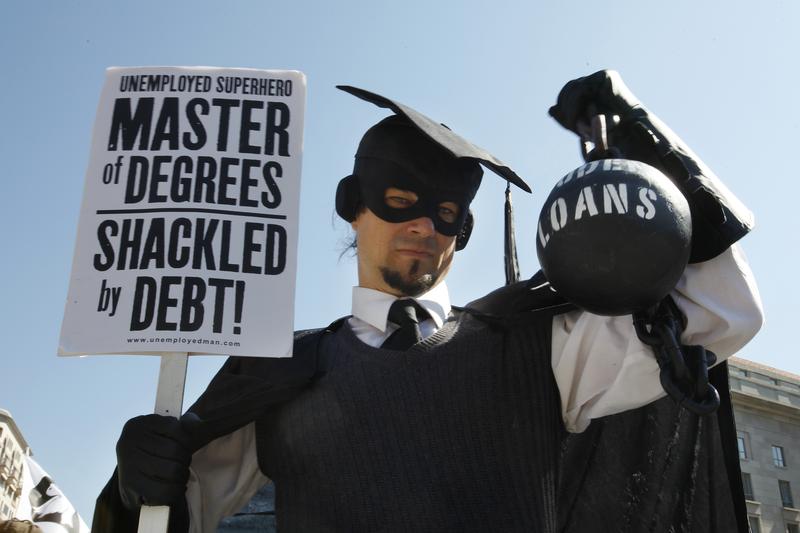

( Jacquelyn Martin / AP Photo )

[music]

Brian Lehrer: Brian Lehrer on WNYC. Let's dig into the details now of President Biden's student debt forgiveness announcement yesterday. We can take your calls on the policy as policy and take your questions about how this might apply to you or someone you know. You've probably heard the basics, $10,000 of debt cancellation for anyone making $125,000 a year or less, 20,000 in debt cancellation if you received a Pell Grant for college.

Pell Grants go to lower-income students, if you don't know and don't have to be paid back but generally do not cover the full cost of a college education so Pell Grant recipients have lots of student debt too. The president emphasizes that the debt relief will be targeted at those who need it most and since most people are not rich or living large, he says 95% of student debt borrowers can benefit from these actions. Listen.

President Biden: That's 43 million people. Of the 43 million, over 60% of Pell Grant recipients, that's 27 million people who will get $20,000 in debt relief. Nearly 45% can have their student debt fully canceled, that's 20 million people who can start getting on with their lives.

Brian Lehrer: President Biden in a video released by The White House yesterday. As part of this announcement, Biden said that the pause on federal student loan repayment that's been in effect during the pandemic will be extended one final time through the end of the year and they'll restart in January.

With me now to answer your questions on how it affects you and also talk about the policy and the politics of this is Danielle Douglas-Gabriel, national higher education reporter at The Washington Post who focuses on the economics of higher education. Hi, Danielle, thanks for making time for us on a big news day on your beat. Welcome back to WNYC.

Danielle Douglas-Gabriel: Thanks for having me back.

Brian Lehrer: Listeners, we can take your questions about the president's debt cancellation plan on how it affects you or people you know or to support or question the policy. 212-433-WNYC, 212-433-9692. Current students, we want to hear from you. Students who are 33 and still paying back loans, we want to hear from you. Students who are 63 and still paying back loans-- we had a call like that recently, you too.

Yes, those of you who did already pay back your loans and might be asking, "Hey, what about me?" 212-333-WNYC, 212-433-9692 or tweet @BrianLehrer. Danielle, I see you wrote an article in The Washington Post about how student debt in America actually shakes out. Who holds student debt?

Danielle Douglas-Gabriel: Well, there is quite a number of people who are over 40 who are holding student debt. There are a lot of young people who folks tend to focus on the most but there are folks, as you'd mentioned, in their 60s still paying off their debt. A lot of times, the folks I've spoken to in that population decided to go back to school to sharpen their skills during the great recession, tried new fields, and as a result, encountered debt that they're still having trouble paying off.

In other instances, they have taken out loans to support their own child's education. It's really across the board. It's not just young people that we're talking about here.

Brian Lehrer: What do folks have to do to move to the practical side here in order to actually have their debt forgiven if they qualify? I see that some people will have the debt forgiven automatically if I'm seeing this right, others will have to apply in some way.

Danielle Douglas-Gabriel: Yes. About 8 million people who would benefit from this will have their debt erased automatically. That's because the education department has their income data on file. For the remainder folks, they will have to do a simple form from what I'm hearing. I haven't seen the form yet, so I can't attest to how simple it is, but they're supposed to submit an attestation form showing their income and that they qualify. The form has not come out yet.

Once it does go live, we will certainly be alerting our readers to its existence and giving them some kind of guidance to be able to get through it. That should be out within the next month or so from what I'm hearing from the Department of Education. I get the sense that the president extended the payment pause to give the department some time to really work through this process.

Brian Lehrer: Are Parent PLUS Loans included? The federal loans that parents of undergrads can use sometimes to help the kids pay for college.

Danielle Douglas-Gabriel: Yes, they are, as are Grad PLUS Loans which are the loans that graduate students can take out to pay for their advanced degrees.

Brian Lehrer: Does a parent have to be making less than $125,000 or $250,000 if they're a couple in order to qualify?

Danielle Douglas-Gabriel: Yes, and that's based on adjusted gross income.

Brian Lehrer: You just said grad students. I thought graduate school loans were not included in this debt cancellation. Which is it?

Danielle Douglas-Gabriel: No, they are included, yes. The only form of loans that is still under some decision from what I'm hearing from the department of education and I don't think this has changed yet is this older bank-based loan that was very prevalent before 2010 called FFEL. There are two different types. There is FFEL that's held by the Department of Education and there's FFEL that's held by commercial entities.

The latter one, the ones that's held by private entities, I think there's still some discussion as to whether those will be included. What I'm guessing as has been the case in other programs and initiatives the department has done, you may have to consolidate that loan into a newer direct loan to take advantage, but I haven't gotten confirmation on that yet. All the other types of loan, Grad PLUS, Parent PLUS, undergrad, Stafford, and unsub and subsidized, all of those count as well as FFEL that's held by the Department of Education.

Brian Lehrer: All right. That's very clarifying.

Danielle Douglas-Gabriel: Sorry. That was an exhaustive [unintelligible 00:06:22] .

Brian Lehrer: No, that was really helpful for a lot of--

Danielle Douglas-Gabriel: People like details.

Brian Lehrer: Yes, because we have listeners in all of those categories I'm sure and it hasn't been in the top line of the articles and the broadcast stories and online, so that's really great that you said all that. Politically, Republicans are united against this from what I've seen claiming it's inflationary. A few of the more Centrist Democrats are also taking that position especially if they're running in competitive swing districts in the midterms.

Does the debt relief come solely from the taxpayers or does some of it come from banks that made some of these loans?

Danielle Douglas-Gabriel: Well, not necessarily the banks. This is uncollected money. This is money that the government had booked that it was going to collect even though to be totally honest, there are a lot of uncollected student debt because of people who are delinquent and default and even when their wages are garnished, and such the government doesn't typically get back the full amount and often spends a lot of money chasing that money and never collecting it.

In this instance, yes, this is money that's really going to be absorbed by the federal lending program itself. I guess a lot of folks keep saying it's on the backs of taxpayers, but it's not like you're going to see an increase in your taxes to offset this particular program. It doesn't quite work like that.

I certainly understand folks who are very concerned about the fairness aspect for people who didn't go to college and the majority of Americans did not and for also people who went to college, didn't borrow, or who went to college, borrowed, and repaid their loans. That has been an argument of many people.

The inflation aspect, certainly, I think the president tried to address this yesterday by saying that many of the measures that his administration has taken thus far has helped to bring down inflation and to address that. While yes, this could potentially have a marginal impact on inflation, his belief is that his administration has done enough that it will not have a material impact. This particular policy will not have a material impact on inflation.

Brian Lehrer: All right. We'll take a short break here and then there's a lot more to do with Danielle Douglas-Gabriel who is a higher education reporter for The Washington Post, but so specific to this student loan issue, she focuses on the economics of higher education. We'll start taking your phone calls for her. We'll get into whether this announcement does anything to keep down the cost of college in the first place for the future and more, stay with us.

[music]

Brian Lehrer: Brian Lehrer on WNYC as we're digging into the details of President Biden's student debt forgiveness announcement yesterday with Danielle Douglas-Gabriel who focuses on the economics of higher education as a Washington Post correspondent. Janine in Brooklyn, you're on WNYC. Hi, Janine.

Janine: Hi, Brian. How are you? My student loan has been my shame for many years living in New York. My question is about the interest accrued on these student loans. My loan was $10,000 in 1993, and I've always paid it. I pay over 50% of my income in rent and expenses living in New York and my loan is now over $50,000. I have paid over $20,000 in interest in the past, probably more than $20,000, never paying my principal. I'm dealing with a lawyer. It was one of those self loans from the '90s and I got it consolidated. What have you heard about interest because I've never hear anyone talking about how the banks are making interests on those of us who, if we had deferred, I've always paid my debts or tried. I paid what I could.

If I had deferred this loan, would've dropped off five years ago, but since I've now had it refinanced, I will have to, if I still make what I make now, I will be in my 70s and then it'll drop off.

Brian Lehrer: Wow.

Janine: What are they talking about? Are they talking about interest? That's what my lawyer-- because now I actually have a lawyer and he's like, "This situation is horrible," but I'm not alone and I'm someone who had paid. During the pandemic, I paid $5,000 in interest over the pandemic interest that was on this loan. He was like, "Why did you do that?" He's like, "You didn't have the money to pay that, but the money that you made, you just gave to them and you're just going to keep accruing interest."

Brian Lehrer: Wow. Janine, what a story. I'll tell you, Danielle, we have at least one other caller on the board-- I'll let Danielle basically speak for both of them, who also has interest that is so much more than the original principle of the student loan. Are they being taken care of in any way by this?

Danielle Douglas-Gabriel: Well, unfortunately not. The interest does still accrue on the debt and that is a common issue that I've heard from borrowers of how they do not understand how they started out with 10,000 in principle and in some cases are double where they were, even though they've been paying. Certainly, with the FFEL loan that the caller had referenced, some of the interest rates on those loans were 8%, 9% free in the '90s.

If you had multiple loans from different years, you could have a different interest rate on each of those loans. Even when you consolidate, it may lower it a little bit, but not anything that's really material. Right now, there is a proposal that the Biden administration put out to try to limit what's called interest capitalization. Now, this is another one of those nefarious ways in which interest can really impact your student loan.

Sometimes if you put your loans in forbearance or deferment when you're having a hard time paying, the minute you come out of that forbearance or deferment, the interest that accrued on the debt gets added to the principle and then you're paying interest on your principal plus the interest. It's a really horrible way that can really increase the balance for a lot of people.

Biden administration has a rule out that may take effect next summer that's trying to address that issue, but the overall issue of the way interest accrues aside from interest capitalization is still on the table at this stage.

Brian Lehrer: A critic of the policy, I believe, David in Englewood, you're on WNYC. Hi, David, thanks for calling.

David: Good. Thank you. Listen. I want to bring up just a couple points I made forward to the screener, but one of the points I want to make up is people like myself are suckers because I went to graduate school at Northwestern University. I paid my entire student loan back. It took me 10 years of sacrifice, but I paid every penny back plus interest. Now, all of a sudden come December that magic month, now you have to start paying it back, it's all political and it's outrageous.

You're going to have a plumber or a car salesman or a bus driver paying for someone to go to law school. This whole canard that this doesn't-- the taxpayer is not picking this up wouldn't pass Accounting 101 and I was an accounting major. This is one of the most outrageous things I've ever heard of and remember, when the student loans were taken over completely by the government in 2010, Obama said, "Oh, this is going to lower the cost of student loans, lower default, and all this other stuff."

They took it over so that they could do something like this to get votes and people that paid their student loans are just suckers. They're just suckers and then teaches young people the wrong message. In other words, you can sign a contract voluntarily and oh, the government will just let you walk away from it and let the taxpayer pick up the tab. It's outrageous.

Brian Lehrer: David, thank you. What would president Biden say to David's critiques? Both on the "moral hazard", what he was describing at the end. What lesson does this teach to young people about their responsibility to pay back their loans? What about him and some other Americans feeling like suckers for having paid back their loans?

Danielle Douglas-Gabriel: I think Biden's position and I think we certainly heard that in a very robust defense of the policy yesterday is that this is a one time deal. That's one, and that it is crafted in a way so that the majority of the benefits go to people who are earning less than $75,000 a year, not the doctors and lawyers with six figure incomes. That's not who's benefiting the most.

I think the addition of Pell being a proxy for trying to address first generation students, low income students is another way that the Biden administration is trying to make sure this is more targeted. 60% of borrowers had Pell Grants during their college career. Pell Grants are for folks whose families typically make under $60,000, half of them under 30,000. I think that has been the argument I've heard from the administration addressing those sorts of issues about who is receiving this relief.

Brian Lehrer: Here, I think is the flip side of the same question. Let's see what Laura in Manhattan has to say and ask. Laura, you're on WNYC, hi.

Laura: Hi, thank you for taking my call. I might be already answered, but my question was for students who are already in college now, will this have any effect on them and if not, it seems like if this is just a one time deal, that students who are accruing debt and especially the interest that starts accruing as soon as they are starting school and can't pay it back until after they've graduated, it sounds like we're going to be still in the same situation years out, if there's not more attention paid to the relief and high interest rates and dealing with student loans coming out of school in the future.

Do you have any idea how that has been addressed or thought about going forward?

Brian Lehrer: Danielle?

Danielle Douglas-Gabriel: Yes. Actually, all loans that were originated and all loans, except for that potential commercial FFEL bit that were originated before June 30th, 2022, the relief would apply to those loans. That includes students who are currently in college. That could be sophomores, that could be juniors, seniors, and in some instances, freshmen, I guess if they've signed their promissory note already and the disbursement has commenced, so they are getting bene some benefit for this.

You're right, there is a lot of concern about this not really addressing the root cause of why people borrow the cost of college necessarily and also the wage stagnation that makes it impossible for families' comes to keep up with the cost of college. The president said that in the accountability aspect that he's trying to address and create a more holistic approach to this issue of higher education would be looking at the schools that are performing the best for students.

What are their outcomes? How are they serving their students? Are a lot of their students ending up with debt and few prospects for being able to repay that five years out, 10 years out? Not exactly sure what that accountability looks like in a practical matter. I think we're going to get more information about that going forward, but there are also other rules in the works to try to address some of that issue of cost and the value of higher education.

The administration is, from their standpoint, trying to make a more holistic approach so that this debt cancellation isn't the centerpiece of how they address affordability, access, and the value of higher education.

Brian Lehrer: This is WNYC FM, HD, and AM New York, WNJT-FM 88.1 Trenton, WNJP 88.5 Sussex, WNJY 89.3 Netcong, and WNJO 90.3 Toms River. We are New York and New Jersey public radio and live streaming at wnyc.org. A few more minutes diving into the details of President Biden's student loan forgiveness announcement yesterday with Danielle Douglas-Gabriel, who covers the economics of higher education for The Washington Post.

As a follow up to the answer you just gave to the caller, Laura, one of the other critiques that I've heard in the last day from Republicans is that, "Hey, colleges are still allowed to raise tuition and there's nothing in here that really holds down the underlying issue, which is the ever-increasing cost of college." I saw President Biden in the announcement yesterday talking about how they would hold fraudulent colleges accountable for offering worthless degrees but that's not to say anything about the vast majority of schools that are legitimate colleges, all the colleges everybody's ever heard of generally but where tuition and other costs associated with attending are going up and up and up for such a long time at a much faster rate than overall inflation.

Maybe this year, overall inflation caught up, but more and more and more and more expensive college. Does this do anything to get it that or are we going to have the same conversation in 10 years, 20 years, with this generation of students?

Danielle Douglas-Gabriel: This policy, no, does not address that. The Biden administration probably would say that there are other policies that they're working on, more transparency about the cost and the outcomes that they're hoping will help. Also, accountability for for-profit schools, of course, was an allusion to the gainful employment rule which is supposed to measure how many graduates of career colleges.

This isn't just for profits. It's also a lot of community colleges that offer trade programs and other sorts of career programs. Whether or not their students are graduating with more debt than their credential is allowing them to repay. There are those measures that are taking place parallel to what was announced yesterday but certainly, no, it's not going to be enough to address the cost of higher education.

I do think, however, that some of the market dynamics will start to impact higher education and may force more schools to think about their value proposition to families. In the sense that enrollment is down at regional publics, at small private liberal arts schools, and the least selective sorts of schools and I do believe that that's going to put pressure on their bottom line. Tuition revenue is a huge deal for most schools and that's how they keep their doors open.

If they cannot fill the seats, they'll have to think about ways of whether their value proposition makes sense to families anymore. I imagine we may see some kind of price constraints come about as a result, maybe at the margins, but I do feel that will have an impact.

Brian Lehrer: You wrote in the Post before the announcement that the issue has divided democratic lawmakers and policy experts influential with the administration, putting Biden in a spot in which he's guaranteed to antagonize some supporters. Advocates say the president should fulfill the campaign promise to alleviate the large debt burdens of millions of young Americans and critics say that could exacerbate inflation while mostly benefiting high-income college graduates who do not need assistance.

Well, we've talked about that. He addressed the high income, the cut-off of who's eligible but still, you wrote, "Administration officials must choose between canceling substantial debt, potentially giving Republicans a new talking point ahead of the midterm elections, and infuriating young voters and racial justice organizations whose support they also need at the polls." There has been some lack of enthusiasm about this.

Derrick Johnson, head of the NAACP, who'd been advocating for a $50,000 cancellation, said it's a decent start, but not what they were hoping for with just $10,000 or 20,000 for Pell Grant recipients. Can you talk about the racial justice aspect of this? Why is this an NAACP issue?

Danielle Douglas-Gabriel: I think the issue here in part is that the majority of student debt is being shouldered by Black borrowers and if we want to get more specific, by Black women, and for myriad reasons. Lack of financial resources in order to afford colleges, also labor market discrimination that has pushed many Black borrowers to go to grad school in order to stay competitive with white counterparts who have less education.

All of those factors are kind of playing into this explosion of debt we've seen among the Black borrowers in the last decade. This has become a racial justice issue because it was, at least in the eyes of people like Derrick Johnson and others who are really pushing for racial equity, it was racial discrimination and structural racism that led to wealth inequality that made it necessary for Black folks to need to borrow at the levels that we've seen.

Any policy that addresses that kind of disparity would have to really think about the racial implications. Certainly, the push was for 50 and it wasn't just him. It was folks like Majority Leader, Chuck Schumer, Senator Elizabeth Warren, Congresswoman Ayanna Pressley, and many others had really pushed for the 50,000, in part, because that would wipe away the debt of like 95% of folks who hold student loan debt.

It would address some of those racial inequalities but the president had always stood firm on the 10,000. I think a lot of people were surprised to see the addition of the Pell bonus of sorts, that gave a lot of people 20,000 but he had never really wavered in his hesitancy to provide so much cancellation, and certainly, his questioning of whether it would get to working-class people, to low income, middle-income people. I think by putting the Pell feature in there, it addresses a lot of those concerns.

Brian Lehrer: Last thing as we run out of time, I see you have another piece in The Washington Post out today. 10 other ways to get your student loans forgiven? Do you want to list off a few of those other ways and then we're out of time?

Danielle Douglas-Gabriel: Sure, because I thought about really quickly writing that piece in case people were like, "Okay, I still have debt, now what?" Certainly, Public Service Loan Forgiveness, you work for 10 years in a public sector, making payments on your loans, whatever is the remaining balance can get forgiven by the government. Working for AmeriCorps, you can also get a scholarship that was essentially-- an award that would allow you to pay off your loans.

Teacher loan forgiveness. This is a federal program that pays up to 17,500 on your loans if you work as a teacher in a high-needs area for X amount of years. There are also state programs. Every state has at least one student loan forgiveness program usually geared towards high-needs areas, social workers, nurses, anyone within public health oftentimes, teachers, definitely, goodness, they're joining the military. There are lots of education benefits that come with service to our country.

Goodness, let me think what else is there because I did get 10 and I was going to keep going. Oh, the other thing is there are a lot of private employers who are offering these student loan repayment perks as a part of their compensation packages. This had really picked up and then during the pandemic, we started to see it fall off some because a lot of private companies were like, "You know what? Instead of doing that, I will offer you emergency loans.

If you're having a hard time with childcare, I'll offer you have emergency childcare payments and such." Now, as we're coming out of the closures and lockdowns and such, I'm seeing more large companies and some middle-sized companies starting to offer student loan repayment as a perk. There was recent congressional laws that have made it easier for companies to do that in terms of the tax benefits of it for them.

I think you're going to see a lot more of that too but I do encourage people to do the research and look to see what's out there. You'd be surprised, especially on the state level, how expansive some of these programs are.

Brian Lehrer: Danielle Douglas-Gabriel reports on the economics of higher education. Thanks for filling in our listeners on so many of the details of the Biden plan, and adding that wonderful caveat at the end on some of the 10 other ways to get your students loan forgiven and from your new article. Danielle, thank you very much.

Danielle Douglas-Gabriel: Thanks so much for having me.

Brian Lehrer: Obviously, listeners, we'll have a lot more coverage of this student loan forgiveness announcement on the station later today and in the coming days. One thing you might be interested in is next Tuesday, Alison Stewart on All Of It will have Betsy Mayotte, president of the Institute of Student Loan Advisors. That'll be another call this next Tuesday here on the station and of course, a lot more even throughout the day as people digest the President's announcement.

Copyright © 2022 New York Public Radio. All rights reserved. Visit our website terms of use at www.wnyc.org for further information.

New York Public Radio transcripts are created on a rush deadline, often by contractors. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of New York Public Radio’s programming is the audio record.